Discovering the Power of TrendMaster Forex Trading Robot

When exploring the world of automated trading, the TrendMaster Forex Trading Robot often stands out as a potential game-changer. Employing advanced algorithms and deep learning technology, this robot promises to revolutionize how traders approach the forex market. Let's dive into an in-depth review to see if it lives up to the hype.

Key Features of TrendMaster Forex Trading Robot

- Advanced Deep Learning: Analyzes nearly a decade of market data.

- Risk Management: Uses stop losses and hedging to minimize risks.

- Trend Judgment System: Enhances trade accuracy by aligning with market trends.

- Versatile Trading Strategy: Suitable for different types of forex traders.

- Broker and Platform Compatibility: Functions well with most ECN brokers and requires a VPS for optimal performance.

A Closer Look at Technology and Strategy

Harnessing Technology for Smarter Trading

The core of TrendMaster EA lies in its use of deep learning technologies to scrutinize extensive historical market data. This approach is designed to refine decision-making and adapt to evolving market trends effectively. By learning from the past, TrendMaster aims to forecast future market movements with higher precision.

Strategy Beyond High-Frequency Trading

Contrary to the common high-frequency scalping strategies, TrendMaster focuses on larger market fluctuations. This strategy allows traders to engage in the market without committing large lot sizes, thereby potentially reducing risk while still taking advantage of significant market opportunities.

Understanding the Mechanisms

Safeguarding Investments

One of the standout features of the TrendMaster EA is its strategic avoidance of high-risk trading tactics like the grid or martingale systems. Instead, it places a stop loss on each order and provides hedging during major market shifts. This proactive approach aims to shield traders from substantial losses, enhancing the safety of their investments.

Adapting to Market Conditions

Recently, the developers introduced a trend judgment system that filters trades against the prevailing market trend. This selective trading not only reduces the number of transactions but also aims to increase the accuracy and profitability of those executed.

Skepticism and Reality Check

Questioning Deep Learning Implementation

Despite these advanced features, there is skepticism about the actual use of deep learning within the TrendMaster EA. True deep learning integration requires significant computational power and sophisticated algorithm configurations. In many instances within the forex robot industry, such claims are often more aligned with marketing strategies rather than actual capabilities.

Importance of Verification

For potential users, it's crucial to verify these claims. Testing the EA in a demo account for at least a week is advisable. Understanding how the TrendMaster operates in real-time helps in making an informed decision about its deployment in live trading scenarios.

Practical Recommendations for Users

Getting Started with TrendMaster FX EA

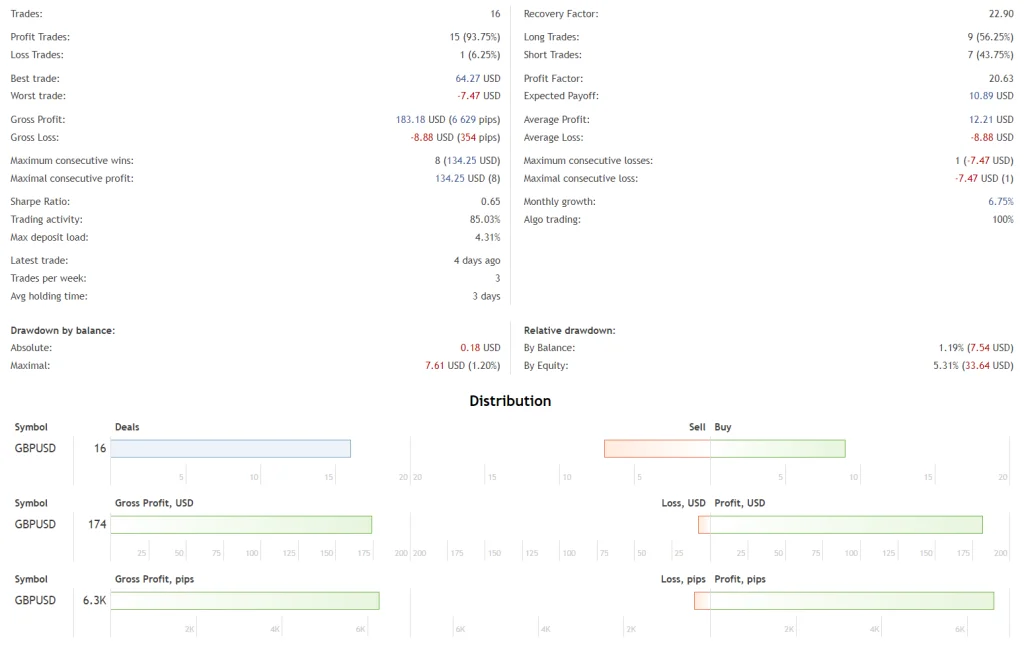

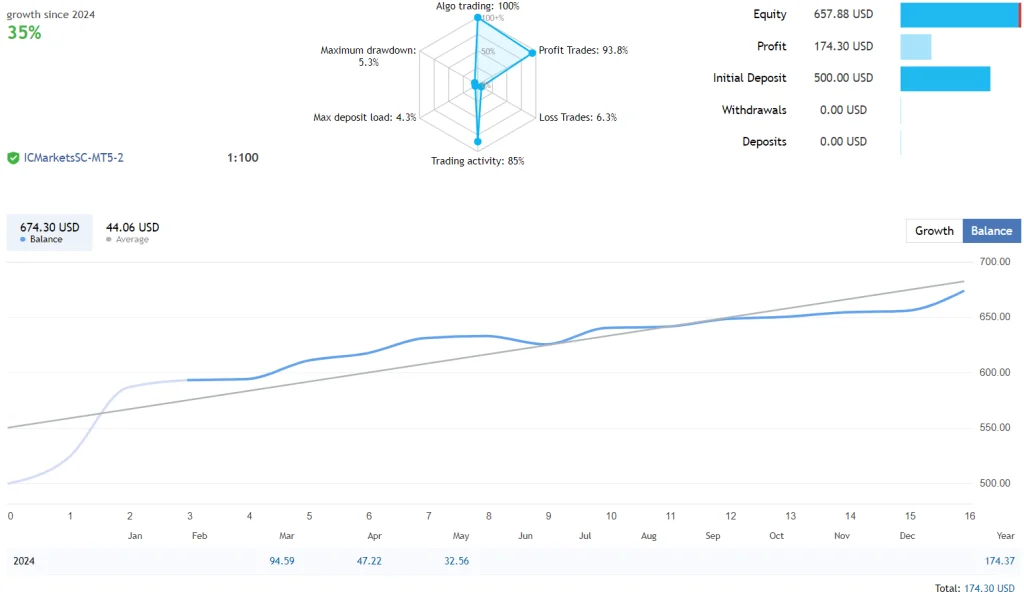

- Initial Investment: Start with a minimum of $500.

- Preferred Currency Pairs: Works best with GBPUSD, but also effective with USDCAD, AUDUSD, EURUSD, and USDCHF.

- TimeFrame: Initially set on a weekly timeframe to gather data, then switch to M15 for regular trading.

- Risk Settings: Aggressive traders may opt for a higher risk setting, while conservative traders should start low to familiarize themselves with the system's dynamics.

- Infrastructure: For consistent performance, running the EA on a reliable VPS is recommended, alongside choosing a competent ECN broker.

Conclusion: Weighing the Pros and Cons of TrendMaster EA

The TrendMaster Forex Trading Robot presents itself as a sophisticated tool with the promise of leveraging cutting-edge technology for profitable trading. However, traders should approach with caution, seeking out independent reviews and performance metrics to gauge its effectiveness. Like any trading tool, it should integrate into a broader, strategic trading plan that emphasizes stringent risk management to safeguard against market volatilities.

By keeping informed and cautiously optimistic, traders can potentially harness the capabilities of TrendMaster to enhance their trading outcomes while managing the inherent risks of forex trading.