Harmonic Pattern Indicator MT4: A Powerful Tool for Forex Traders

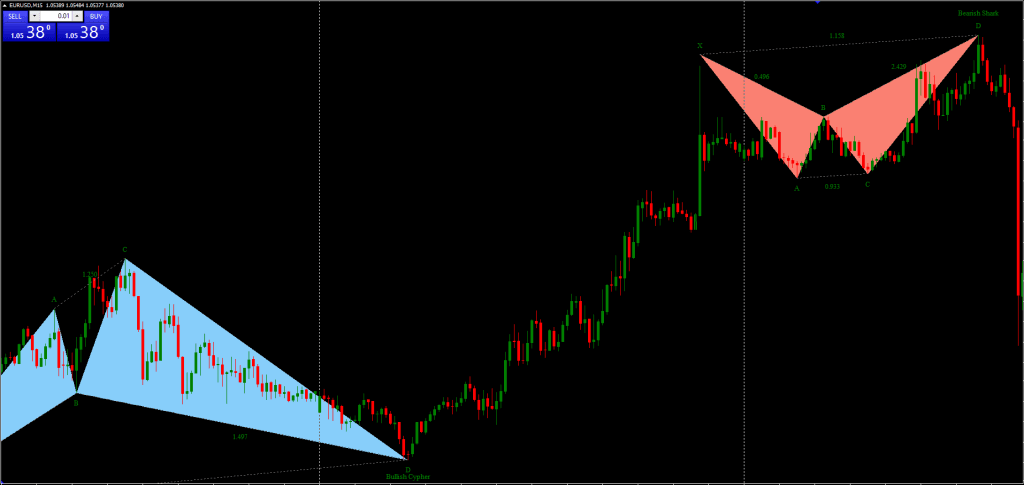

The Harmonic Pattern Indicator MT4 helps traders detect harmonic patterns in real-time. It identifies six key patterns—Gartley, Butterfly, Crab, Bat, Cypher, and Shark—and automatically marks them on the chart. The indicator also plots Fibonacci ratios within each pattern and sends alerts when a valid pattern completes. Additionally, traders can view historical patterns and analyze potential formations.

Key Features of the Harmonic Pattern Indicator MT4

- Detects six major harmonic patterns: Gartley, Butterfly, Crab, Bat, Cypher, and Shark.

- Automatically plots Fibonacci retracement and extension levels.

- Provides real-time alerts for pattern completion.

- Displays historical, potential, and pending patterns.

- Helps traders make informed entry and exit decisions.

- Works seamlessly within the MetaTrader 4 platform.

Understanding Harmonic Patterns in Forex Trading

Harmonic patterns follow specific Fibonacci retracement and extension levels. Traders use these patterns to identify potential reversal points in the market. Unlike traditional chart formations, harmonic patterns rely on precise price measurements to confirm setups.

Common harmonic patterns include:

- Gartley Pattern

- Butterfly Pattern

- Crab Pattern

- Bat Pattern

- Cypher Pattern

- Shark Pattern

Each pattern consists of multiple price swings that follow Fibonacci-based geometric formations. Traders analyze these shapes to predict future price movements.

How Traders Use Harmonic Patterns in MT4

Traders use the Harmonic Pattern Indicator MT4 to identify trade setups with high probability. Here’s how the process works:

1. Identifying the Pattern

The indicator scans the market and detects harmonic formations. It then highlights them on the chart, making it easy for traders to analyze potential setups.

2. Confirming with Fibonacci Ratios

Traders compare the detected pattern against Fibonacci retracement and extension levels. If the pattern aligns with expected measurements, it strengthens the trade signal.

3. Executing Trades

After confirming a valid pattern, traders place buy or sell orders at predicted reversal points. The indicator helps traders pinpoint optimal entry levels.

4. Managing Risk with Stop-Loss and Take-Profit

Traders use Fibonacci extensions and retracement levels to set stop-loss and take-profit targets. This ensures a structured risk-reward approach to trading.

Example Trading Strategies Using Harmonic Patterns

To illustrate how traders use this tool, let’s examine two trading examples: a bullish trade using the Crab pattern and a bearish trade using the Cypher pattern.

Example 1: Bullish Crab Pattern

Entry Rule

- Wait for the indicator to detect a bullish Crab pattern.

- Place a pending buy order just above the last candlestick within the pattern.

- If the price moves higher, the order executes automatically.

Exit & Stop-Loss Rule

- Use a trailing stop set at three times the ATR (Average True Range).

- Example: If ATR = 50 pips, set the trailing stop at 150 pips.

Example 2: Bearish Cypher Pattern

Entry Rule

- Wait for the indicator to detect a bearish Cypher pattern.

- Place a pending sell order below the last candlestick in the pattern.

- If the price moves lower, the sell order activates.

Exit & Stop-Loss Rule

- Apply a trailing stop equal to three times the ATR.

Quick Tip: How to Calculate ATR Pip Value

Use these calculations to determine the correct ATR pip value for setting stop-loss levels:

- For currency pairs with four decimal places (e.g., EUR/USD): Multiply ATR by 10,000.

- Example: If ATR = 0.0016, then pip value = 16 pips.

- For currency pairs with two decimal places (e.g., USD/JPY): Multiply ATR by 100.

- Example: If ATR = 0.25, then pip value = 25 pips.

This method ensures precise stop-loss placement and better risk management.

Why Traders Should Use the Harmonic Pattern Indicator MT4

The Harmonic Pattern Indicator MT4 enhances market analysis and improves trade accuracy. Here’s why traders should consider using it:

- Time-Saving Automation: The indicator eliminates manual pattern detection, saving traders hours of analysis.

- Accurate Market Signals: It uses Fibonacci ratios to identify high-probability trade setups.

- Custom Alerts & Notifications: Traders receive real-time alerts for new patterns, ensuring timely trade execution.

- Works on Any Timeframe: The indicator supports multiple timeframes, from M1 to Monthly charts.

- Improves Trading Discipline: By following predefined rules, traders avoid emotional decision-making.

Conclusion: Elevate Your Forex Trading with Harmonic Patterns

The Harmonic Pattern Indicator MT4 provides traders with a structured approach to harmonic trading. While it does not guarantee 100% accuracy, it significantly improves trade entry and risk management. By using Fibonacci ratios and geometric patterns, traders can identify high-probability reversal points and execute trades with greater confidence.

To maximize results, traders should combine the Harmonic Pattern Indicator MT4 with additional confirmation tools like trend indicators or price action strategies. Practicing on a demo account before going live helps traders gain experience and fine-tune their strategies.

For those looking to enhance their Forex trading skills, this indicator serves as a powerful tool for spotting profitable trade opportunities.