Boring Pips MT4 Robot: The Secret to Consistent Success in Live Trading

Have you ever wondered why most expert advisors (EAs) fail in live trading despite their perfect backtest performance? The answer often lies in a concept known as overfitting. Overfitting occurs when an EA is tailored so closely to historical data that it fails to predict future market movements accurately. This lack of generalizability makes the expert advisors ineffective in real trading scenarios.

Key Features of the Boring Pips MT4 Robot

- Trading Strategies: Momentum, Supply and Demand Zones, Fibonacci Retracement, Artificial Intelligence

- Recommended Pairs: AUDNZD, NZDCAD, AUDCAD

- Time-frame: M5

- Multi-Currency EA: Yes, operates on one chart for all symbols

- Takeprofit: Yes, with trailing

- Stoploss: Yes, fixed

- Grid and Martingale: Optional

- Manual Risk Management: Yes, includes stop entrying and closing all positions

The Problem of Overfitting in EAs

Many developers either don’t know about overfitting or don’t have methods to prevent it. Some even use overfitting intentionally to make their backtest results look appealing. They add numerous input parameters without considering statistical significance, making their trading strategies excessively tailored to historical data. This creates an illusion of potential future performance which rarely holds true in live trading.

How to Avoid Overfitted EAs

To avoid losing money on an EA that merely reads past data, follow these tips:

- Never use an EA without at least 5 months of live trading results or 300 tracked trades, regardless of its backtest results.

- Monitor the live trading performance to see how the EA handles real, unseen data.

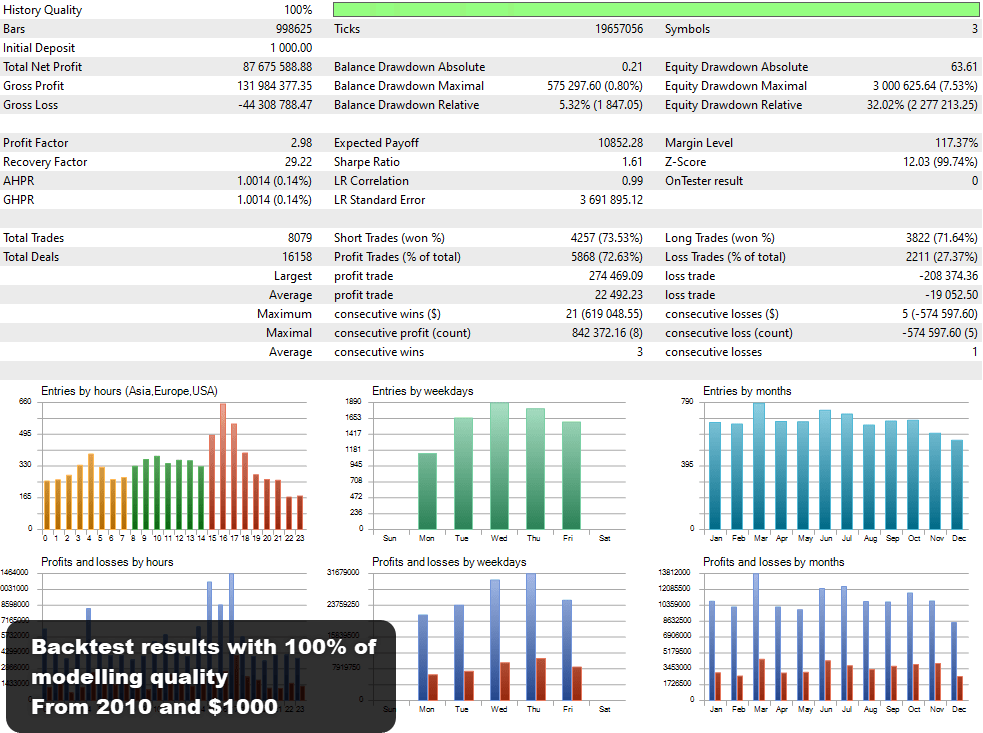

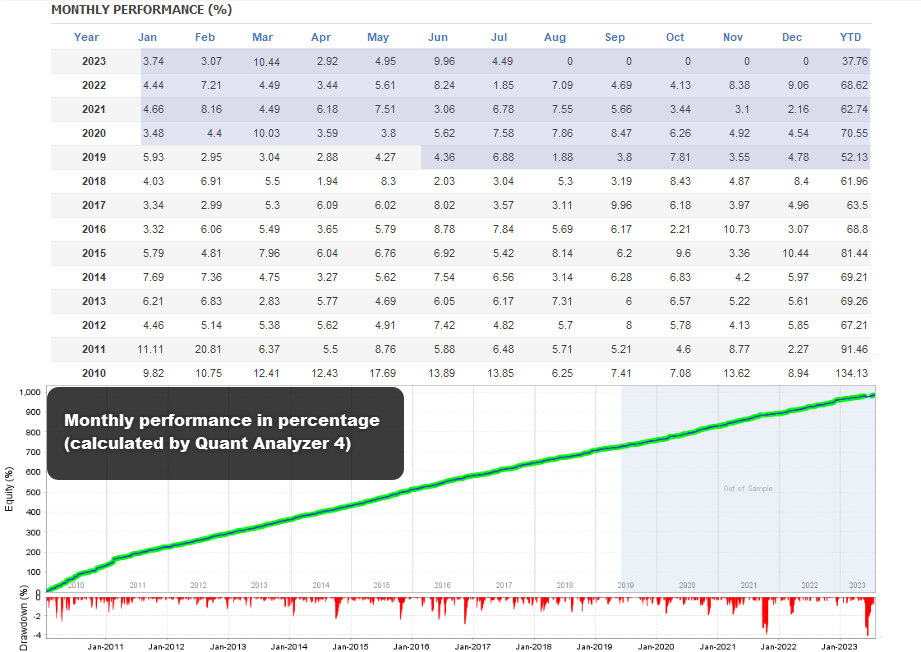

The Boring Pips Optimization Process

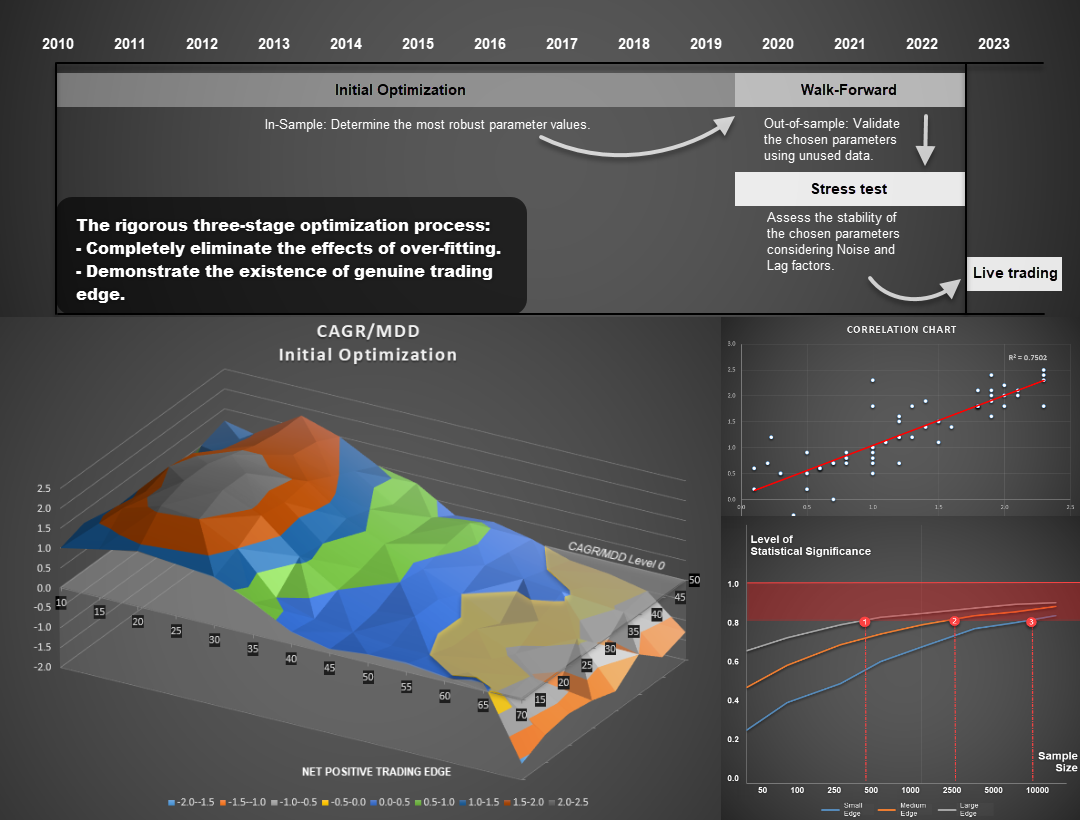

Boring Pips uses a rigorous validation process called Anti-overfitting, ensuring the EA remains effective and generalizable. This process involves three stages:

Initial Optimization

The first stage optimizes the EA using historical data from 2010 to 2019. This phase tests the initial premise of the trading strategy and identifies robust parameter values.

Walk-Forward Testing

In the second stage, parameters that performed well in the initial phase are tested using new data from 2019 to 2022. This ensures the EA’s stability and predictive power with fresh data.

Stress Testing

The final stage introduces variables like noise and lag to the optimized parameters to test the system’s resilience. This simulation pushes the EA beyond its comfort zone, assessing its tolerance to random factors.

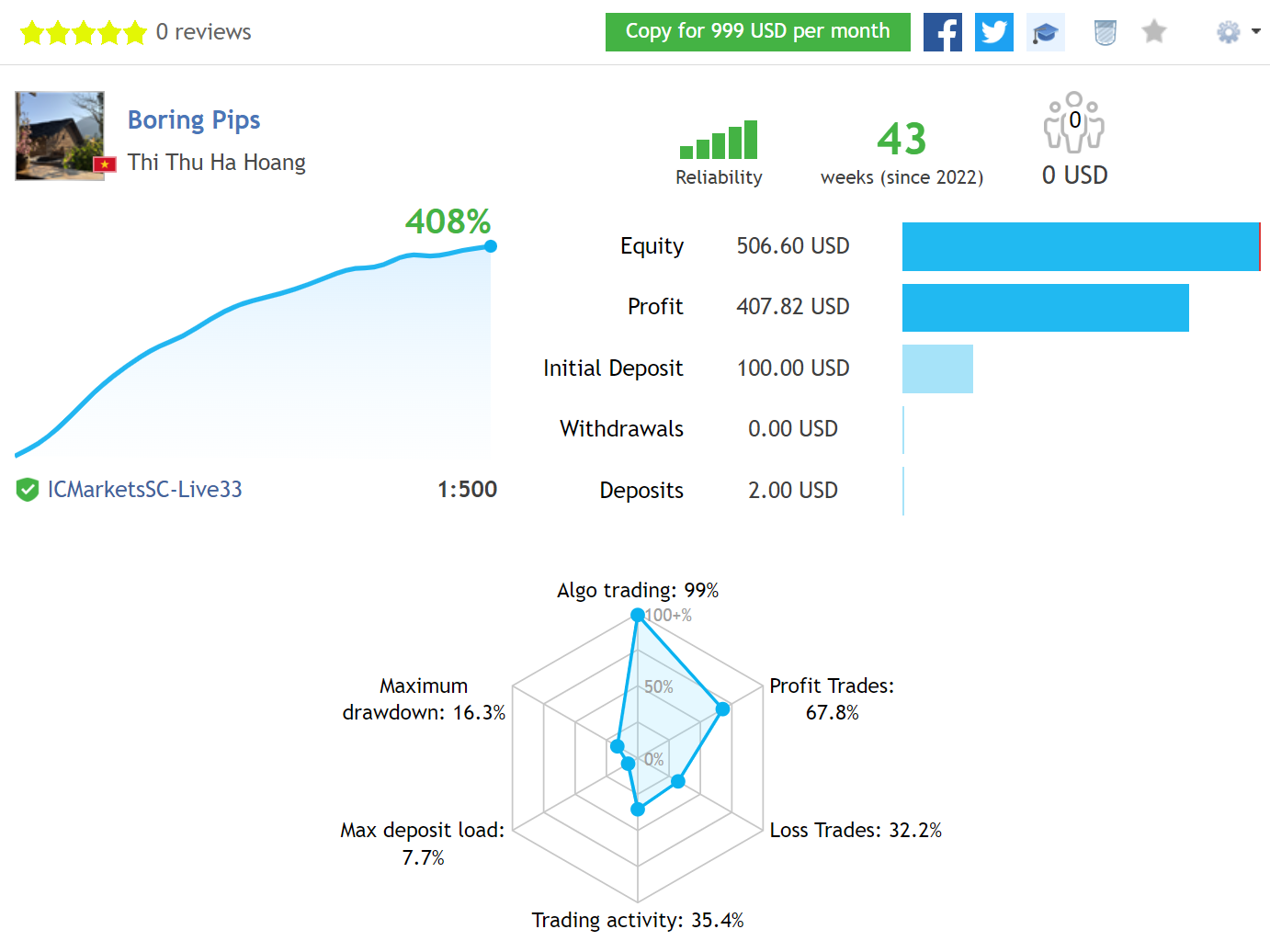

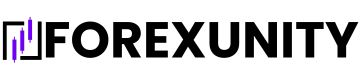

Boring Pips MT4 Robot: Live Trading Monitoring

Since October 10, 2022, the most robust parameter values from the Anti-overfitting process have been tested in a real account. This real-time testing ensures that the EA can handle live market conditions effectively.

Introducing the Boring Pips Algorithm

The Boring Pips trading system combines advanced artificial intelligence algorithms with classic trading strategies, including momentum, supply and demand zones, and Fibonacci retracement. The EA uses a deep learning algorithm to measure price momentum across four time-frames. It identifies potential supply and demand zones, making informed trading decisions based on price momentum synchronization. The entire process, from signal scanning to trade execution, is automated in four steps:

- Supply and Demand Zone Scanning: The algorithm continuously scans for potential price reaction areas.

- Momentum Detection: A sophisticated AI algorithm detects changes in price momentum across different time-frames after a significant price movement.

- Trading Decision: The EA makes trading decisions when price momentum decreases at previously identified zones, predicting a reversal.

- Trade Management: Trades are managed based on a probability distribution rule to maximize the trading edge.

Installation and Setup

To install Boring Pips, follow these steps:

- Install on a Chart: Use one of the AUDCAD, AUDNZD, or NZDCAD charts with an M5 time-frame.

- Select Trading Symbols: Choose the optimized trading currency pairs (AUDCAD, AUDNZD, NZDCAD).

- Select Risk Mode: Choose an appropriate risk mode (Boring, Low risk, Medium risk, or High risk).

- Set Base Balance: Decide on the amount of balance to allocate for trading.

- Personalize Settings: Refer to the detailed instructions for personalization and risk management settings.

Conclusion

The Boring Pips MT4 Robot stands out by addressing the common pitfalls of overfitting that plague many expert advisors. By using a robust optimization process and real-time performance tracking, Boring Pips ensures its effectiveness in live trading environments. This combination of advanced AI and classic trading strategies makes it a reliable choice for traders looking to achieve consistent results.