Aura Neuron Trading Robot (Free Download)

Aura Neuron Trading Robot is an automated forex EA designed for EURUSD and GOLD, claiming to integrate AI-driven strategies with fixed risk management. It avoids high-risk techniques like martingale and grid trading, aiming for stable performance under various market conditions.

Aura Neuron Trading Robot: Does It Live Up to the Hype?

Automated trading solutions have transformed forex trading. Traders now rely on expert advisors (EAs) to execute strategies without manual intervention. One such system is the Aura Neuron Trading Robot, an EA that claims to integrate artificial intelligence with traditional trading strategies.

Aura Neuron specifically targets EURUSD and GOLD trading pairs. It avoids high-risk strategies like martingale, grid trading, or averaging. Instead, it implements fixed stop–loss and take-profit settings. The developers claim that it remains broker-independent, making it a flexible choice for traders.

Key Features of Aura Neuron Trading Robot

- No high-risk strategies: No martingale, grid, or averaging.

- Fixed stop-loss and take-profit: Clear risk management parameters.

- Works on EURUSD and GOLD: Optimized for these currency pairs.

- H1 TimeFrame recommended: Supports any timeframe, but H1 is preferred.

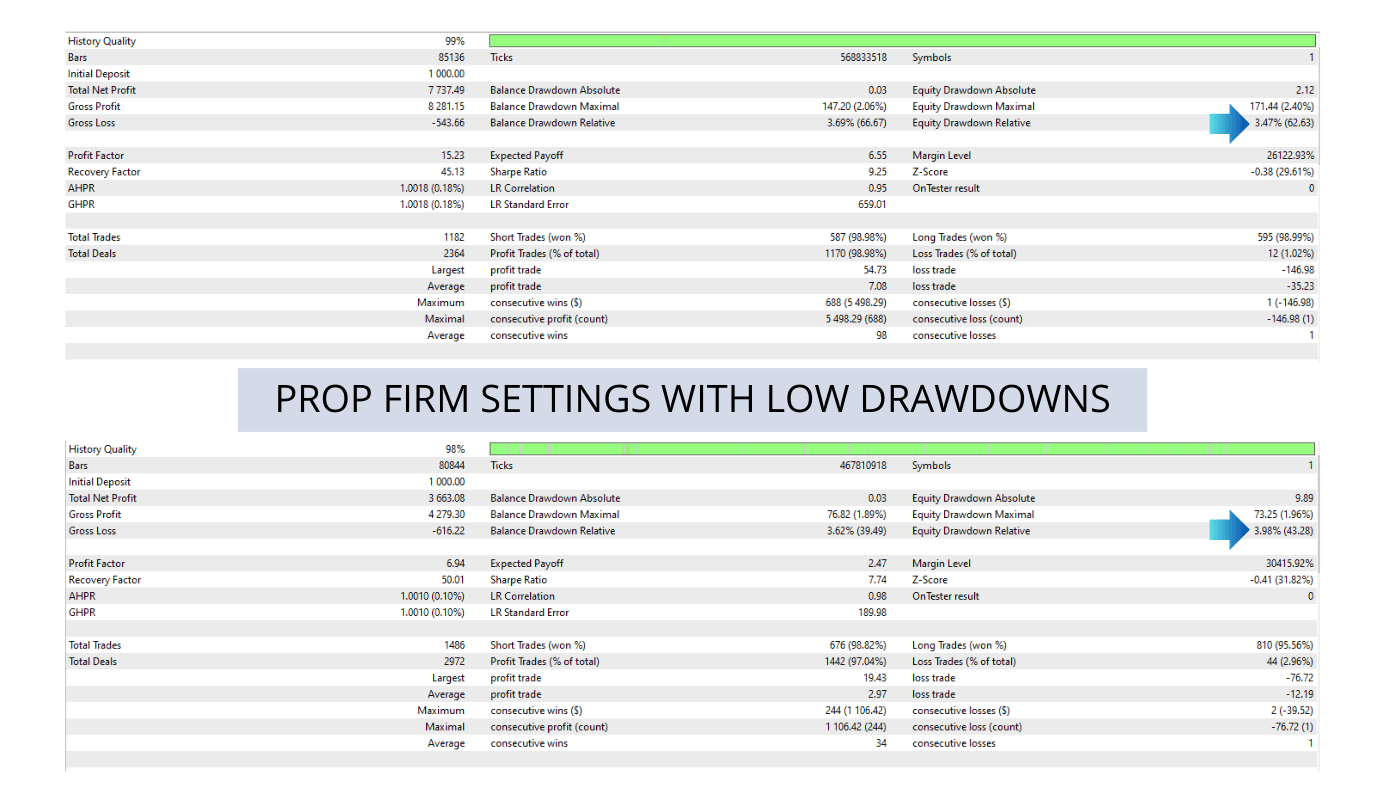

- Compatible with FTMO challenges: Meets proprietary trading firm requirements.

- VPS recommended: Ensures uninterrupted operation.

- Low spread accounts preferred: Reduces trading costs.

Understanding the Role of Neural Networks in Aura Neuron

One of the standout claims of Aura Neuron is its integration of neural networks. The EA reportedly uses a multilayer perceptron (MLP) neural network to analyze market conditions. Neural networks, in theory, can identify complex patterns that traditional indicators might miss.

MLPs consist of input layers, hidden layers, and output layers. These networks undergo training to detect trends, optimize entry points, and improve trading decisions. However, there is no independent verification of Aura Neuron’s AI claims. Traders should approach such claims with skepticism and seek real-world proof of effectiveness.

Additionally, even when EAs employ AI, market unpredictability remains a challenge. Many neural-network-based systems perform well in backtests but fail under live market conditions. The effectiveness of AI-driven trading largely depends on continuous adaptation, and it remains unclear if Aura Neuron possesses this capability.

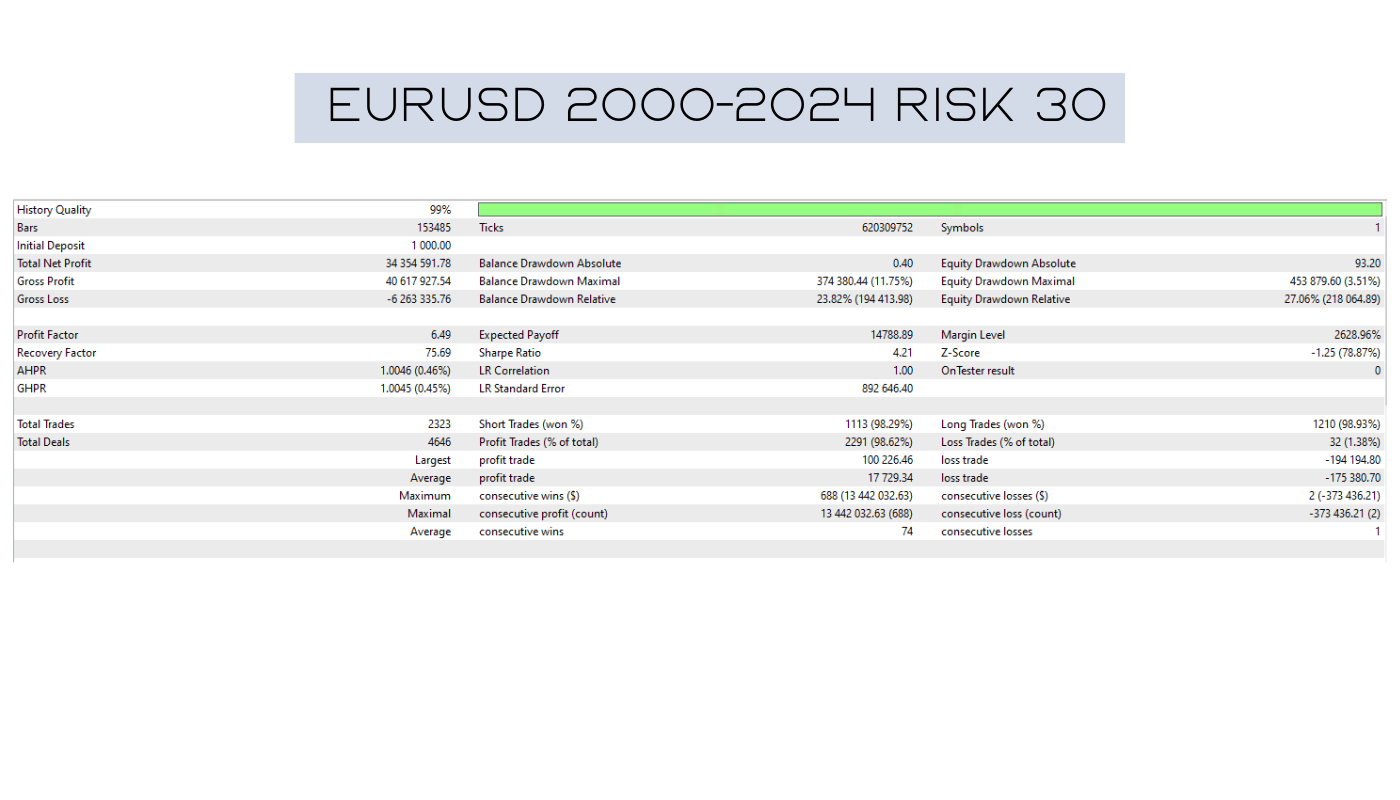

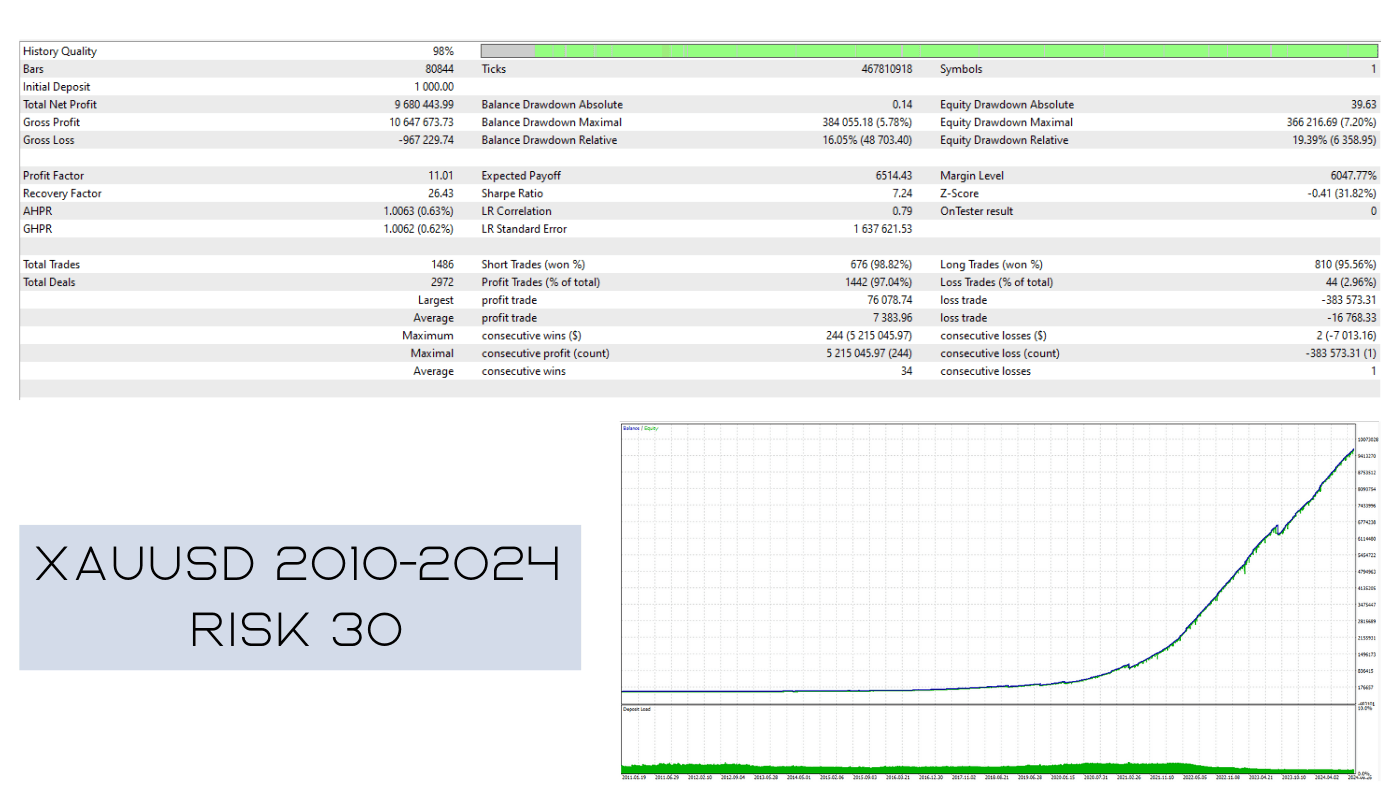

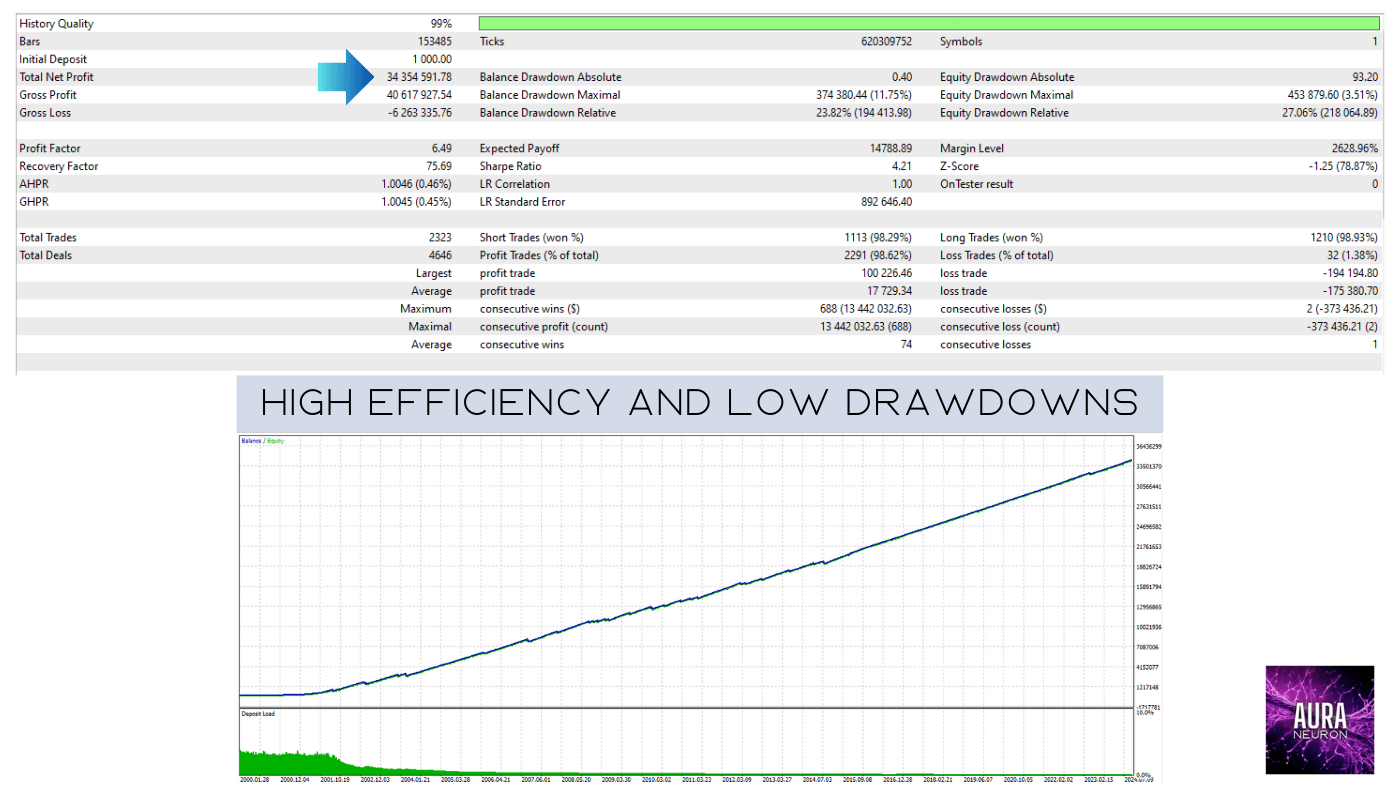

Performance Testing and Historical Data

Aura Neuron’s developers provide backtested results from 1999 to 2023. These tests suggest stable performance over two decades. While long-term backtesting provides insights, it does not guarantee real-world success. Market conditions constantly evolve, and an EA that performed well in the past may not maintain the same profitability in the future.

Traders should run the EA on a demo account for at least a week before committing real funds. Observing how the bot performs under live market conditions is crucial.

Recommendations for Optimal Performance

To achieve the best results with Aura Neuron, follow these guidelines:

- Use a minimum balance of $100: Ensures the EA operates effectively.

- Trade EURUSD and XAUUSD: The robot is optimized for these pairs.

- Run on an H1 timeframe: Although it supports any timeframe, H1 is preferred.

- Use a VPS: Prevents interruptions and ensures stable operation.

- Choose a low-spread broker: Reduces trading costs and slippage.

- Enable WebRequests in MetaTrader:

- Go to Tools > Options > Expert Advisors

- Check “Allow WebRequests for listed URL”

- Add:

https://sslecal2.forexprostools.com - Click “OK”

The EA retrieves news updates from this source to adjust trading behavior accordingly.

Is Aura Neuron Worth Trying?

Aura Neuron provides a structured approach to trading without using high-risk money management strategies. The claim of integrating artificial neural networks adds intrigue, but the lack of independent verification raises concerns.

Traders should take the following precautions before investing:

- Test it on a demo account: Never risk real capital before evaluating live performance.

- Compare performance with other EAs: Look at alternative options.

- Monitor live results: Backtesting alone is insufficient.

Conclusion

Aura Neuron positions itself as an advanced AI-based trading solution with strong historical performance. However, traders should remain cautious about unverified claims regarding neural network integration. While the EA avoids risky strategies and offers clear stop-loss and take-profit parameters, its real-world effectiveness remains uncertain.

For those interested in an automated trading system, Aura Neuron might be worth exploring. However, proper testing and risk management are essential. Always trade responsibly and stay informed about the latest performance updates before committing significant funds.