Red Hawk Trading Robot: The Ultimate Guide to Profitable Trading

In the world of Forex trading, finding a reliable and profitable trading robot can seem daunting. Many traders, especially beginners, often fall into the trap of using systems that promise high returns but deliver inconsistent results. The Red Hawk Trading Robot stands out as a solution that prioritizes stability and safety. This article explores the key features of the Red Hawk Trading Robot and provides an in-depth guide on how to set it up for optimal performance.

Why Choose the Red Hawk Trading Robot?

The Red Hawk Trading Robot operates as a “mean reversion” system. It trades during the quieter periods of the market, focusing on nine currency pairs: EURUSD, GBPUSD, USDCHF, EURCHF, EURGBP, AUDCAD, AUDJPY, EURAUD, and USDCAD. This specific strategy aims to capitalize on market conditions where price corrections are likely, making it a reliable choice for traders who prefer lower-risk trading approaches.

Key Features of Red Hawk Trading Robot

- Mean Reversion Strategy: Focuses on trading during low-volatility periods for higher accuracy.

- Nine Supported Currency Pairs: Trades on EURUSD, GBPUSD, USDCHF, EURCHF, EURGBP, AUDCAD, AUDJPY, EURAUD, and USDCAD.

- M5 Timeframe: Optimized for the M5 (5-minute) chart for quick and efficient trading.

- Safety Mechanisms: Includes stop-loss and take-profit settings, along with multiple trailing stop-loss techniques.

- No Risky Techniques: Avoids dangerous strategies like grid or martingale trading.

- Automatic Execution: Fully automated with no need for manual intervention.

- Internal Filters: Ensures trading only occurs during optimal market conditions.

The Red Hawk Trading Robot’s mean reversion strategy is its most notable feature. It trades when the market is quiet, avoiding the noise and erratic movements that can lead to unnecessary losses. This approach works particularly well on the M5 timeframe, providing quick trades while minimizing risk.

How to Set Up the Robot for Success

Setting up the Red Hawk Trading Robot is straightforward, even for those new to Forex trading. The simplicity of its setup process, combined with its robust internal settings, makes it accessible and user-friendly.

Installation and Basic Configuration

Start by installing the EA (Expert Advisor) on an M5 chart for each supported currency pair. You don’t need any additional set files, as the necessary settings are already embedded in the EA for optimized pairs. The default configuration is tailored for most brokers, but you may need to adjust the GMT offset depending on your broker’s settings.

Adjusting the GMT Offset

The Red Hawk Trading Robot’s effectiveness depends on trading during specific times, typically around rollover hours. Therefore, ensuring the correct GMT offset is crucial. The default setting is GMT offset winter = +2 and GMT offset summer = +3. If your broker operates on a different GMT offset, update the “GMT offset (winter)” parameter to match your broker’s settings. You can check the current GMT offset using this link.

Risk Management Settings

Effective risk management is essential for any trading strategy. The Red Hawk Trading Robot offers several risk settings to suit different trading styles and account sizes.

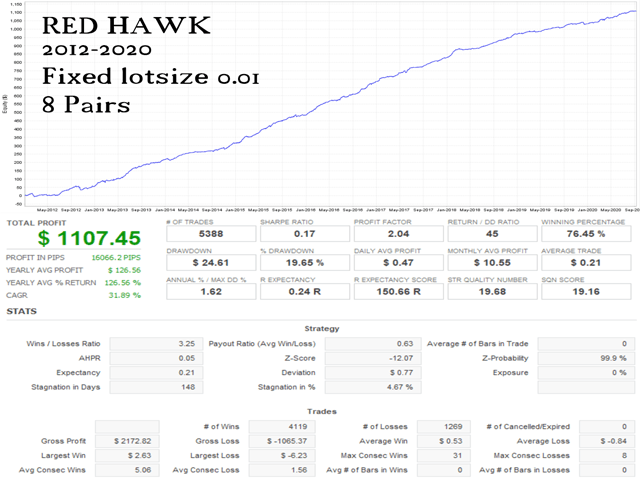

- Fixed Lot Size: By default, the EA trades with a fixed lot size of 0.01. You can adjust this by changing the “StartLots” parameter.

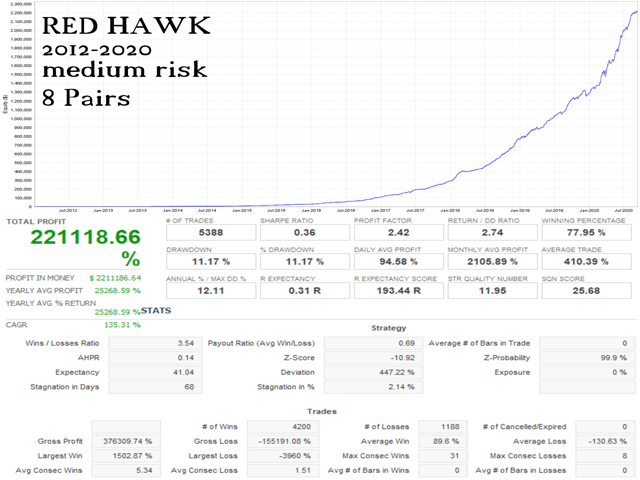

- Automatic Lot Size by Balance: This option scales the lot size according to your account balance. For example, with a LotsizeStep of 250, the EA will trade 0.01 lots per $250 in your account. Adjust the LotsizeStep based on your risk preference: 250 for low risk, 125 for medium risk, and 60 for high risk.

- Lot Size by Risk: Set the maximum risk per trade, which determines the potential loss if the initial stop-loss is hit. This setting ensures that the EA adheres to your risk tolerance while trading.

These settings allow you to tailor the Red Hawk Trading Robot to your risk appetite. Always start with a demo account or a low-risk setup to ensure the strategy aligns with your trading style.

Why To Avoid Risky Trading Techniques

One of the reasons many traders prefer the Red Hawk Trading Robot is its avoidance of risky techniques like grid or martingale trading. These methods can lead to significant drawdowns and potential account wipeouts if not managed correctly. The Red Hawk Trading Robot, however, prioritizes safety and consistency, making it a safer choice for long-term trading.

Built-In Safety Mechanisms

The Red Hawk Trading Robot employs various safety mechanisms to protect your account. Each trade comes with a stop-loss and take-profit setting, reducing the risk of significant losses. The EA also includes multiple trailing stop-loss techniques, which help lock in profits while minimizing potential losses.

Internal Filters for Market Conditions

The EA includes several internal filters that ensure trading only occurs under optimal conditions. It avoids trading during times of high volatility or large spreads, which can lead to unpredictable market behavior. However, it’s still advisable to turn off the EA during extreme news events, such as the U.S. elections, to further mitigate risk.

Long-Term Performance and Stability

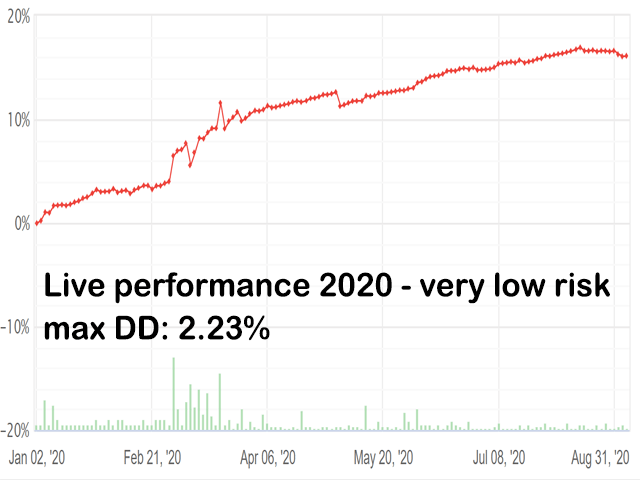

This trading Robot has a proven track record of stable trading with low drawdown over several months. You can check the comments page for live performance updates and testimonials from other traders using the system. This long-term stability makes the Red Hawk Trading Robot a trustworthy option for traders seeking consistent results.

The Importance of Backtesting and Forward Testing

Before committing to live trading, it’s essential to backtest and forward test the Red Hawk Trading Robot. Backtesting allows you to see how the EA would have performed in past market conditions, while forward testing on a demo account gives you a sense of how it handles current market environments. These steps are crucial for verifying the EA’s effectiveness and ensuring it suits your trading style.

Trading Psychology and Expectations

It’s important to manage your expectations when using the Red Hawk Trading Robot. No trading system guarantees profits, and past performance does not ensure future success. Always trade with money you can afford to lose, and consider the psychological aspect of trading. Consistency, discipline, and patience are key to long-term success in Forex trading.

Conclusion: Is the Red Hawk Trading Robot Right for You?

This trading Robot offers a compelling mix of safety, stability, and profitability. Its mean reversion strategy, combined with multiple safety mechanisms, makes it a reliable choice for traders who want to avoid the risks associated with more aggressive trading systems. However, like any trading tool, it requires careful setup, proper risk management, and realistic expectations.

If you’re looking for a trading robot that prioritizes stability over high-risk, high-reward strategies, the Red Hawk Trading Robot could be the perfect addition to your trading arsenal. Start by downloading it and testing it on a demo account to see how it fits your trading style.